michigan use tax exemptions

The passage of the bill comes with support from the Michigan Chamber. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Michigan Sales Tax Exemptions Agile Consulting Group

The state also provides a 2800 special exemption for each tax filer or dependent in the household who is deaf.

. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Yesterday House Bills 5080-5081 which would exempt certain delivery and installation services from sales and use tax passed out of the Michigan Senate Committee on Finance with a 5-2 vote.

See Notice of New Sales and Use Tax Requirements. It now moves onto the Senate floor for next steps. Amends 1937 PA 94.

20591 Use tax act. This act may be cited as the Use Tax Act. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals.

This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. Electronic Funds Transfer EFT Account Update. Michigan Department of Treasury 3372 Rev.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. 2018 Sales Use and Withholding Taxes Amended Annual Return. Tax Exemption Certificate for Donated Motor Vehicle.

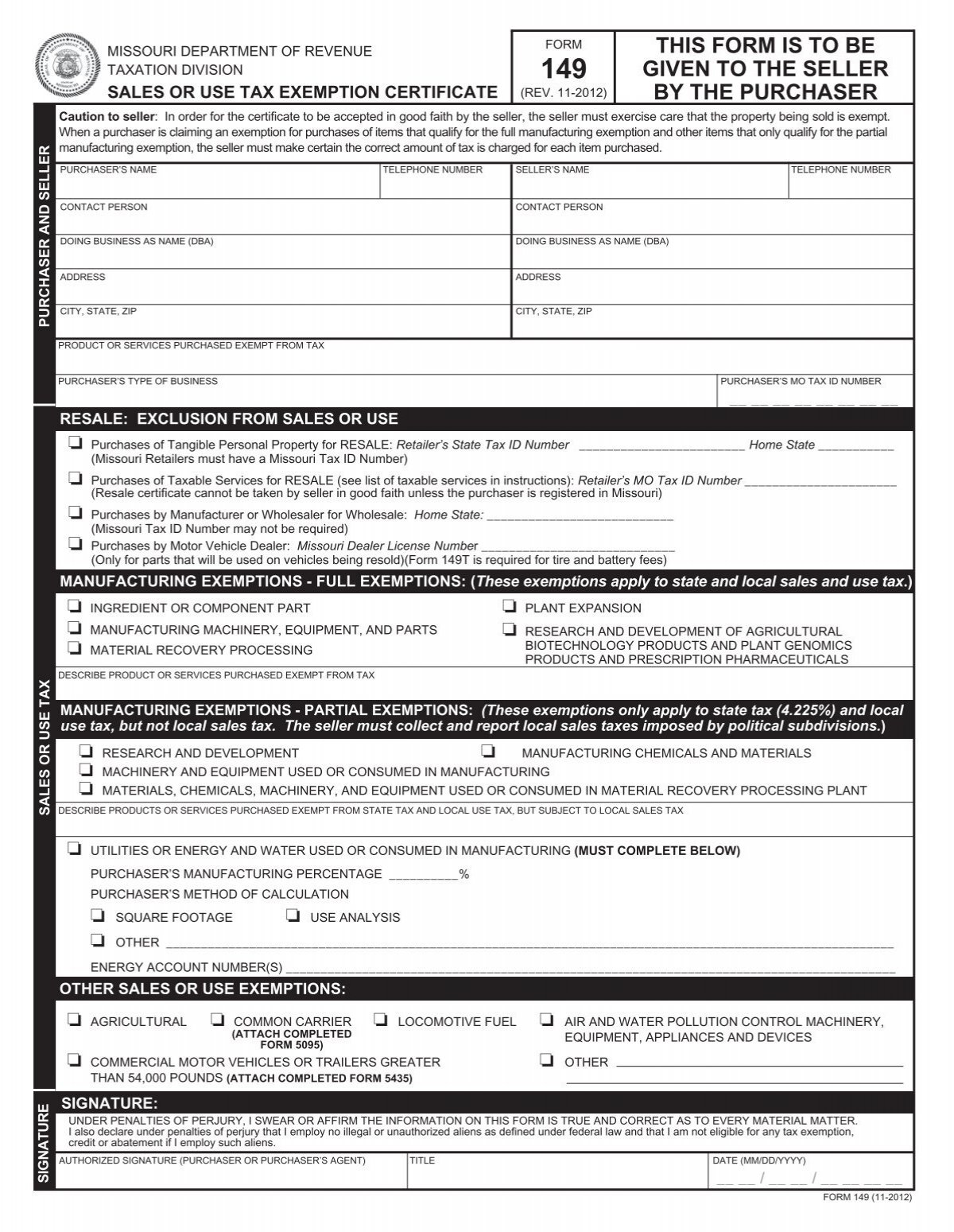

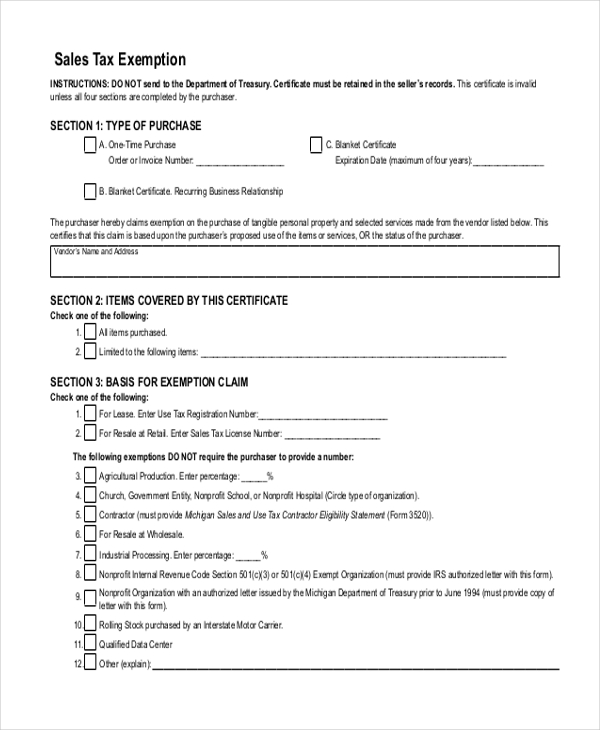

Michigan Sales Tax Exemptions. Michigan Sales and Use Tax Certificate of Exemption. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

04-17 Page 1 of 2 Issued under authority of Public Acts 167 of 1933 94 of 1937 and 281 of 1967 all as amended. Use Tax Exemption on Vehicle Title Transfers. Michigan Sales and Use Tax Contractor Eligibility Statement.

2022 State Sales and Use Tax and Gross Receipts Tax Changes Indiana. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Several states adopted new sales tax exemptions.

The sales tax and use tax statutes operate differently but are intended to supplement and complement each other to collect on the overall 6 tax liability. The manufacturer will fill out and send in one form for each of their qualifying vendors. Do not send a copy to Treasury unless one is requested.

The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit housing organization from property taxes for a maximum period of five years if the property is intended for ultimate occupancy by low-income persons as a principal residence. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions.

As of March 2019 the Michigan Department of Treasury offers. Instead of the previous benchmark of having fewer than 30. An early discount of 075 percent on the first 4 percent of the tax if paid by the 12th of the month.

Thursday June 10 2021. Michigan Sales and Use Tax Certificate of Exemption. History1937 Act 94 Eff.

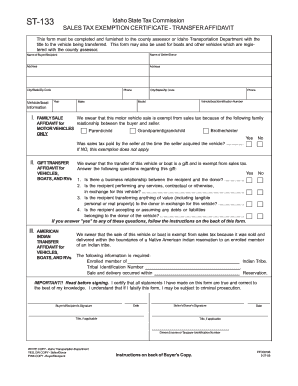

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Use Tax Exemption on Vehicle Title Transfers. Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s to the State of Michigan.

2 Michigan then enacted a law in 2017 providing a sales and use tax exemption for the sale. Transmittal for Magnetic Media Reporting of W-2s W-2Gs and 1099s to the State of Michigan. Michigan Sales and Use Tax Contractor Eligibility Statement.

Michigans use tax rate is six percent. F Purchase price or price means the total amount of. 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

The People of the State of Michigan enact. This page discusses various sales tax exemptions in Michigan. Sales Tax Exemptions in Michigan.

When delivery is outside Michigan states may grant an exemption from sales and use tax on purchases made by the University of Michigan. When the 6 sales tax has already been paid upon the retail sale of property to a customer that personal property is exempt from use tax being paid by the customer. Several examples of exemptions to the states.

Maximum 20000 per month. The purchase or rental must be for University consumption or use and the consideration for these transactions must move from the funds of the. This form can be found on the Michigan Department of Treasurys website.

All claims are subject to audit. There are no local sales taxes in the state of Michigan. This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections.

Sales Tax Return for Special Events. Use tax is also collected on the consumption use or storage of goods in Michigan if sales tax. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

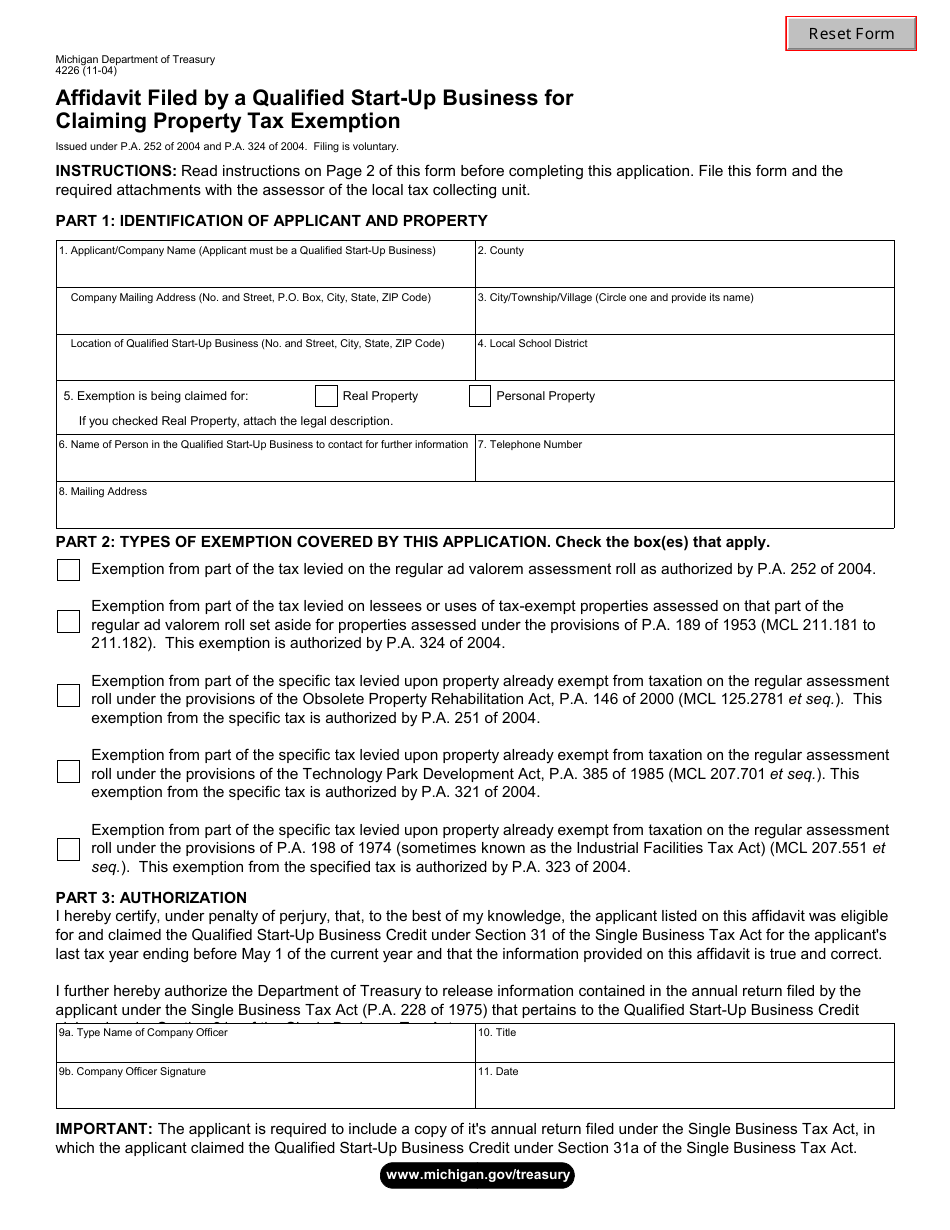

Notice of New Sales Tax Requirements for Out-of-State Sellers. Streamlined Sales and Use Tax Project. Legislation enacted in 2016 created an exemption from sales and use tax on purchases of tangible personal property affixed to and made a structural part of county long-term medical care facilities retroactive to tax years beginning after Dec.

For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. What is Exempt From Sales Tax in Michigan.

For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is personal exemption is available if you are the parent of a stillborn child in 2021. Michigan Department of Treasury 5082 Rev. Minimum 6 maximum 15000 per month.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet by mail or by phone from out-of-state retailers that do not collect and remit sales or use tax from their. Indiana will implement a new threshold for sales tax exemptions for nonprofits beginning in July. An on-time discount of 05 percent on the first 4 percent of the tax.

Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors with Michigan Sales and Use Tax Certificate of Exemption Form 3372. All claims are subject to audit. From the tax levied under this act to a use not exempt from the tax levied under this act.

These and other tax changes taking effect July 1 are detailed below. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Use tax is a companion tax to sales tax.

States that provide exemptions can be identified on the Multistate Sales and Use Tax Exemption Status. The following exemptions DO NOT require the purchaser to provide a number.

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Credits

10 Ways To Be Tax Exempt Howstuffworks

Kentucky Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

What Is Irs Form 1120 Tax Irs Forms Income Tax

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Small Business Guide Truic

Form 149 Sales And Use Tax Exemption Certificate Missouri

Download Policy Brief Template 40 Brief Executive Summary Ms Word

Idaho Sales Tax Exemption Form St 133 Fill Out And Sign Printable Pdf Template Signnow

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Form 4226 Download Fillable Pdf Or Fill Online Affidavit Filed By A Qualified Start Up Business For Claiming Property Tax Exemption Michigan Templateroller